|

My name is Viet-Dung Doan - PhD Student ,

INRIA Sophia Antipolis

2004 Route des Lucioles, BP93, 06902, France

|

|

|

My name is Viet-Dung Doan - PhD Student ,

INRIA Sophia Antipolis

2004 Route des Lucioles, BP93, 06902, France

|

|

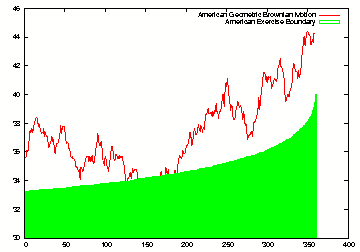

Geometric Brownian Motion with exercise boundary

Geometric Brownian Motion with exercise boundary

|

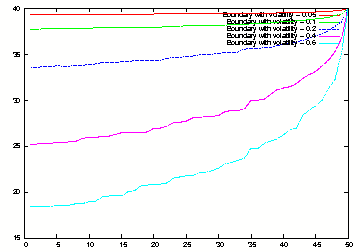

Frontier exericise with stochastic volatilities

Frontier exericise with stochastic volatilities

|

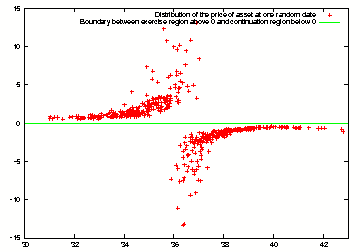

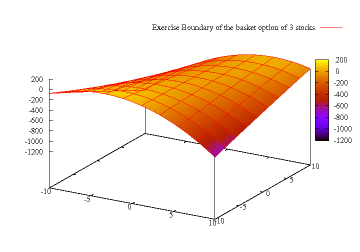

Exercise region above 0 and continuation region below 0 at a random date

Exercise region above 0 and continuation region below 0 at a random date

|

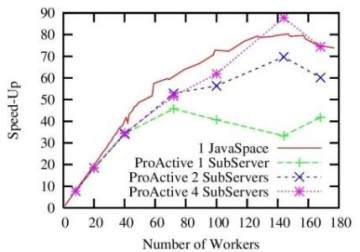

Performance

Performance

|

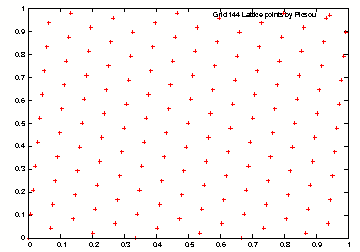

Grid 144 lattice points generated in Java

Grid 144 lattice points generated in Java

|

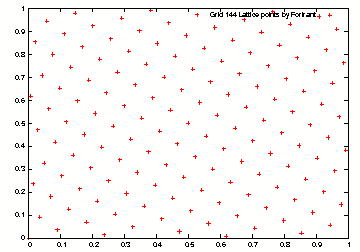

in Fortrant in Fortrant

|

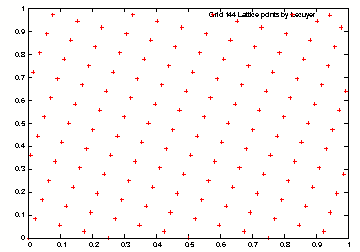

by L'ecuyer by L'ecuyer

|

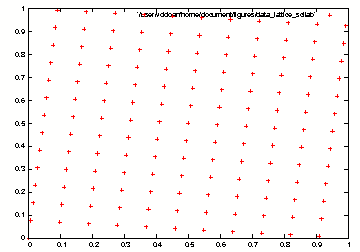

in Scilab in Scilab

|

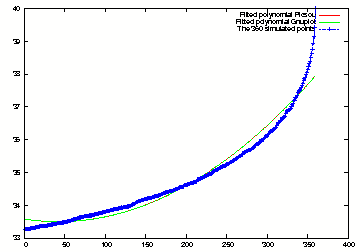

Least Square Regression 2th order polynomial

Least Square Regression 2th order polynomial

|

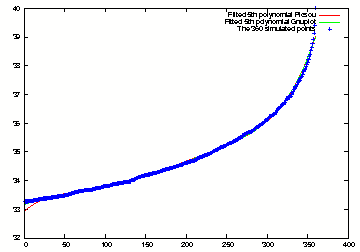

Least Square Regression 5th order polynomial

Least Square Regression 5th order polynomial

|

Weighted and normal least square regression

Weighted and normal least square regression

|

Exercise boundary of American Basket Option (3 stocks)

Exercise boundary of American Basket Option (3 stocks)

|